Recruiting Success: Try a Student Loan Benefit Program

(Editor’s Note: Today’s post is brought to you by EdAssist, one of the pioneers in providing education assistance programs that drive employee growth, retention, and engagement. They manage tuition and student loan programs for approximately 160 large employers, handling more than $500 million in tuition and loan payments each year. Enjoy the post!)

During this year’s SHRM Talent Management Conference, SHRM CEO Hank Jackson talked about five trends reshaping work. The trends were shifting workforce demographics, loss of middle-skills jobs, skills gaps, fewer physical barriers to work and new models of work. In his comments, he mentioned a new trend in employee benefits: student loan benefit programs.

What are student loan benefit programs?

EdAssist was one of the very first providers to offer student loan benefit programs for large employers so I asked Chris Duchesne, vice president at EdAssist, for a high-level definition. “In its most basic form, student loan assistance means that the company agrees to start making payments against an employee’s student debt. A student loan benefit program may also include help and guidance for employees, including the ability to speak with an advisor about repayment strategies.”

It is distinct from a tuition reimbursement program. One big difference is student loan benefits can apply to degrees acquired prior to entering the workforce, as well as those earned during your career (depending on how the policy is designed).

That being said, many employers are starting to design student loan repayment programs that work in partnership with tuition reimbursement as part of a broader education strategy with similar recruitment and retention aims for degreed workers.

The reason student loans are emerging as an employee benefit

Before we talk about the benefits of a student loan repayment program, let’s take a quick step back and mention how we got here. The cost of tuition has been increasing steadily over the past decade. In the early 90’s, college graduates had very little debt, with the average being around $10,000. Today, the average debt at graduation has tripled to about $35,000.

Meanwhile, organizations continue to struggle finding talent. The Association for Talent Development (ATD) recently reported that 75 percent of CEOs find the skills gap to be the biggest threat to their business. There has to be a way to create a win-win for organizations and employees.

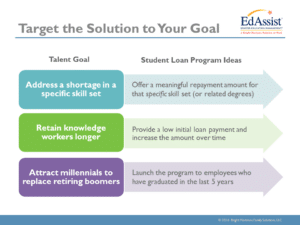

Student loan assistance is a flexible benefit

In learning about EdAssist and their services, I discovered how flexible student loan benefits can be. One of the great things about student loan assistance is that companies can design the program in a way that targets their specific needs for recruitment, engagement, and retention. The thing to remember is that the program should work in unison with other established benefits and fit within the context of company culture.

Some people might be thinking, “Why implement a program that has such a narrow audience?” It’s an excellent question. Let’s do some simple math. Statistics show that the nation’s $1.3 trillion in student loan debt is held by about 43 million people. There are approximately 150 million people working in the U.S. – full-time, part-time, etc. So depending on your workplace, it’s possible that 1 in 3 people are in debt.

When I look at it from that lens, it somehow doesn’t seem quite as narrow of an audience. And don’t forget about benefits like parental leave, child care and elder care, all of which have a defined audience.

The benefits of student loan repayment programs

The top concerns in every organization are recruiting, engaging, and retaining talent. Student loan repayment programs can have a positive impact on all three.

Recruitment: We’ve talked before about the challenges facing recruiters. As the market continues to tighten, companies will be looking for ways to close deals with candidates. In the past, that’s often involved signing bonuses. Instead of presenting a check, think about offering candidates a way to get out of debt.

Engagement: I know we don’t like to think of compensation being a factor in employee engagement, but it is. If employees aren’t able make investments like purchase a home, save for retirement, or even get an advanced degree, then money can be a demotivator. Companies like NVIDIA, an EdAssist client, are helping employees pay off their student loans and allowing employees to improve their financial well-being.

Retention: Benefits are definitely a part of the retention conversation. When employees have benefits they value, they stay. Duchesne was quoted in this Kansas City Star article about the impact of retention. “Student loan repayment benefits help with recruiting, retention, engaging employees and driving loyalty in ways that other programs do not.”

Implementing student loan assistance programs

Today’s student loan dynamic is complex. There’s data out there that says nearly 40 percent of borrowers have 3 or more student loans, and 25 percent of borrowers have had a loan switched to a new service in the last 5 years. Oh, that doesn’t’ include borrower confusion about interest rates.

But organizations don’t have to go it alone. This is one of those situations when a strategic partnership with a professional services firm that specializes in student loan assistance programs makes sense. They can help with design, administration, compliance, and consistency. In addition, some providers offer guidance directly to employees to help with an overall repayment plan – which gives the employee more confidence and focus and provides the company with assurance that the payments are going to the best use.

If you want to learn more about student loan repayment programs, I hope you’ll check out this white paper, “Student Loan Benefit Programs: An Innovative Approach to Engagement and Retention.” It’s time for companies to start doing something new. A student loan benefit just might be the answer.

3